Finance Unzoned Raw Land - Key Considerations

3 minute read

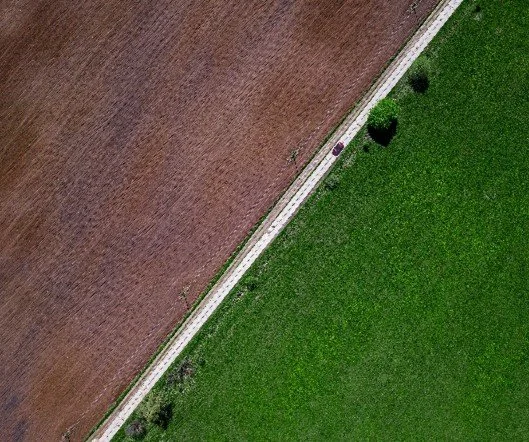

Investing in unzoned raw land offers potential for development, agricultural use, or long-term appreciation, but it also presents unique challenges. Whether you’re a mortgage broker advising clients or a borrower considering such an investment, understanding the risks and strategies for financing unzoned land is crucial. Here’s what to keep in mind when financing unzoned raw land.

Evaluating Location and Potential

Location is key in unzoned land investments. Proximity to developed areas, road access, and local infrastructure affect future use and value. Properties near expanding residential or commercial zones may offer better development prospects, enhancing their appeal.

Conducting Thorough Due Diligence

It’s crucial to evaluate factors such as environmental concerns, utility access, and legal restrictions (easements or encroachments) to avoid unexpected issues that could complicate development plans.

Planning for Additional Costs

Beyond the purchase, budgeting for costs like surveying, land improvements, permits, and legal fees provides a clearer picture of the total investment required.

Considering Long-Term Strategies and Exit Plans

Unzoned land investments often require a long-term view. Encourage clients to think about holding the land for appreciation, developing it, or selling once zoning changes occur. Staying informed about zoning updates and development trends is essential for acting on opportunities.

Recognizing the Challenges of Unzoned Land

Unzoned raw land lacks assigned land use, offering flexibility but also uncertainty. The lack of zoning restrictions can make the land's future use more adaptable, but changes in zoning regulations could impact its value and development potential. It's essential to be aware of local zoning processes and anticipate future changes.

Preparing for Higher Down Payment Requirements

Due to the higher risk associated with unzoned land, lenders typically require larger down payments, often 30% or more. Setting clear expectations about this upfront ensures that borrowers are financially prepared to meet the requirements.

Assessing Financial Strength

Borrowers interested in unzoned land must demonstrate strong financial health, with good credit scores, manageable debt levels, and adequate liquidity. A solid financial profile can improve loan terms by reducing the perceived risk for lenders.

Exploring Financing Options

Traditional mortgages may not be ideal for unzoned land. Consider alternatives such as:

Land Loans: Designed for raw land, these come with higher interest rates and shorter terms.

Seller Financing: Flexible terms from sellers who finance part of the purchase.

Private Lenders or Hard Money Loans: Options when conventional financing is unavailable, but with higher interest rates.

Exploring these options ensures borrowers understand the trade-offs.

Financing unzoned raw land involves complexity and risk, but with proper preparation and strategy, borrowers can make profitable investments. By understanding the unique considerations and exploring alternative financing, brokers and clients can navigate the process effectively.